Insights

Uncovering impact: The power and challenges of the cost-benefit analysis

21/11/2024

With tighter budgets and increasing demands, demonstrating the cost-effectiveness of initiatives has become essential, not optional. This is equally relevant across sectors and industries, where initiatives often generate long-term benefits—such as increased efficiency, cost savings, or improved stakeholder outcomes—that are difficult to quantify upfront. These gains can remain hidden in future budgets or overlooked by decision-makers, making it challenging to secure the recognition and support needed for sustained investment.

Cost-benefit analysis (CBA) offers a potent tool for organisations to demonstrate their value, ensuring resources are allocated where they can yield the greatest returns. The expertise of seasoned CBA practitioners is invaluable in distilling complex data into actionable insights, facilitating clearer conversations with decision-makers. By aligning strategic advocacy with robust analysis, organisations can strengthen their case for investment and secure sustainable outcomes in an increasingly competitive landscape.

What are CBAs and how do they work?

CBA is a key tool in microeconomics, alongside cost-effectiveness (CEA), cost-utility (CUA), and Social Return on Investment (SROI). Its purpose is simple: determine whether a program or policy generates more value than it costs, ensuring efficient resource use.

CBA quantifies costs and benefits in monetary terms, comparing two scenarios: the "assessment case," with the intervention, and the "base case," without it. The difference yields the Net Present Value (NPV)—the surplus of benefits over costs. The Benefit-Cost Ratio (BCR) further expresses value per dollar spent; for example, a BCR of 2.3 means $1 invested returns $2.30.

CBA guides decisions across sectors, from public infrastructure to education and healthcare, helping allocate resources efficiently. Governments and organisations use it to assess potential projects (ex-ante) or evaluate existing ones (ex-post). ACIL Allen applies CBA across various sectors, providing rigorous analysis that helps decision-makers align strategy with impact and maximise value.

What do clients need to provide for a CBA?

We collaborate with clients ranging from large corporations with advanced data systems to smaller organisations focused entirely on service delivery, often with limited data. Our approach identifies the minimum requirements for CBA and systematically addresses gaps. Data typically comprises service data (such as the number of clients served, service type, duration, and outcomes), cost data, (drawn from budgets and financial statements), and benefit data (often developed from external research due to limited client records and based on savings and social outcomes). We adapt to varying data quality by using surveys, desktop research, expert consultation, and sensitivity analysis to fill gaps and develop reliable proxies, ensuring robust, defensible outcomes across all client types.

Why do clients commission CBAs?

CBA is a widely used evaluation tool across government and non-government sectors due to its flexibility, scalability, and cross-sector applicability. It can handle everything from quick assessments for small programs to detailed analyses for large infrastructure projects, with applications spanning health, transport, justice, housing, energy, and education. Central funding bodies endorse CBA and provide guidelines to aid in project selection and justification. While CBA excels at quantifying cost-effectiveness, it is best complemented by qualitative approaches—such as stakeholder consultations—that capture nuances not addressed by data alone, ensuring a more comprehensive evaluation.

Common challenges with CBAs

Common challenges when undertaking CBA include:

- Data availability and quality: a CBA is only as strong as the data it relies on. Poor-quality or missing data compromises accuracy, leading to unreliable conclusions. Highlighting data limitations and conducting sensitivity analyses helps illustrate their impact on outcomes.

- Estimating costs and benefits: valuing intangible benefits like quality of life or environmental preservation is difficult. Forecasting future costs and benefits adds uncertainty, especially for long-term projects where assumptions about economic conditions may change.

- Stakeholder influence and bias: analysts may face pressure from stakeholders with vested interests, which can bias results. Personal or institutional biases also risk compromising objectivity, making vigilance essential to maintain integrity.

- Complexity of interrelationships: costs and benefits often interact in dynamic ways, making it difficult to isolate their effects. Changing social, economic, or environmental conditions require analysts to regularly update assumptions to keep the analysis relevant.

- Regulatory and policy changes: shifting policies can alter CBA parameters, requiring frequent revisions. Compliance with future regulations adds uncertainty, with costs that are difficult to predict accurately over time.

- Communication and interpretation: CBA findings are often complex and prone to misinterpretation. Clear communication of assumptions, limitations, and results is critical to avoid misguided decisions by non-expert stakeholders.

- Distributional and equity impacts: CBAs may overlook how costs and benefits are distributed among different groups, raising equity concerns. Transparent methods and stakeholder engagement help mitigate biases and ensure a fair assessment of impacts and distributional analysis can be used to highlight the distribution of gains and losses across groups.

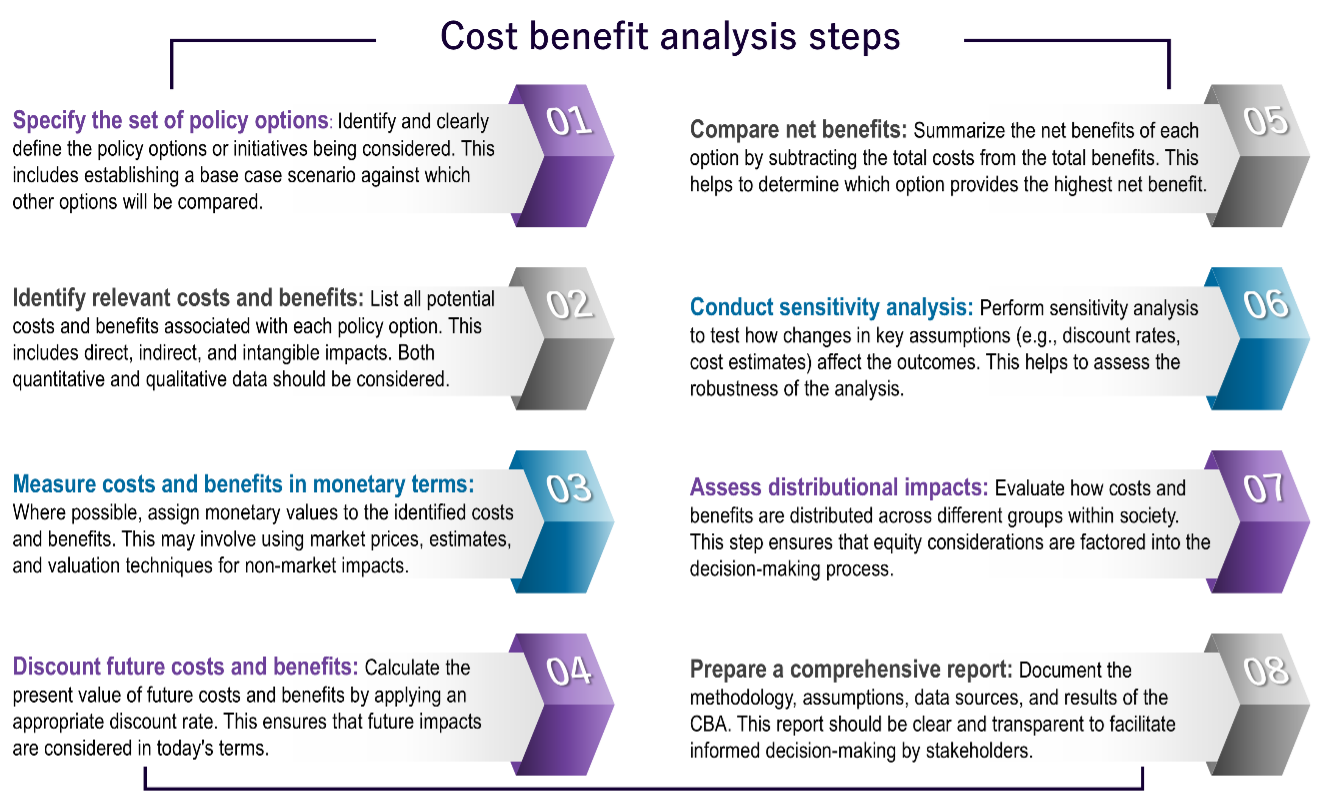

What are the stages in a cost benefit analysis

Conducting a CBA is a highly systematic process. There are numerous guidelines on how to perform analysis – we quite like the Commonwealth Office of Impact Analysis summary of the key stages:

What types of services do clients buy?

We support clients in multiple ways across the CBA lifecycle:

- Methodology reports: we guide clients on how to structure CBAs when evaluation data is unavailable, when measuring non-market impacts, or when clients plan to conduct the analysis independently.

- Project evaluation: we provide independent expertise to assess program impacts and identify areas for improvement.

- CBA models: we develop tailored CBA models to facilitate knowledge transfer, allowing clients to use them across programs or adapt them for internal evaluations.

- Upskilling and knowledge transfer: through workshops and technical guidance, we equip clients with the skills to conduct CBAs effectively, ensuring cost-efficiency where data and expertise already exist.

- CBA review: we assess the quality and validity of existing CBAs, offering feedback to enhance comprehensiveness and ensure the analysis meets high standards.

This multi-faceted approach ensures clients receive practical insights, robust tools, and sustainable evaluation capacity.

Cost-benefit analysis remains a vital tool for organisations and governments striving to allocate resources efficiently and justify investments. By quantifying both tangible and intangible benefits alongside costs, CBA offers clarity in decision-making, even for complex, long-term initiatives. However, its effectiveness relies heavily on the quality of data, the objectivity of the analysis, and the ability to communicate findings clearly. Overcoming these challenges requires not only technical expertise but also a nuanced understanding of stakeholder needs and potential biases.

At its best, CBA can strengthen strategic advocacy and ensure sustained support for initiatives that deliver measurable value. By addressing data gaps, navigating uncertainties, and considering the broader social and economic implications, organisations can enhance their decision-making processes, driving outcomes that maximize both financial returns and societal impact. For any further information, please reach out to any of our consultants or submit an enquiry.